What’s Unique About Nonprofit Financial Statements?

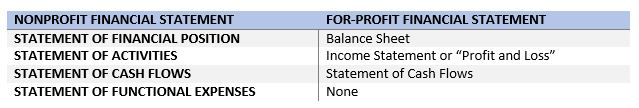

If you’ve ever read a nonprofit organization’s audited financial statements, you may notice that there are some differences from the traditional for-profit balance sheet and income statement. A full set of financial statements for a nonprofit includes: the Statement of Financial Position, Statement of Activities, Statement of Cash Flows and Statement of Functional Expenses. The first three somewhat resemble for-profit financial statements with some key differences. The last, the Statement of Functional Expenses, is unique to nonprofit organizations. We can relate nonprofit financial statements to the following for-profit statements below:

If you’ve ever read a nonprofit organization’s audited financial statements, you may notice that there are some differences from the traditional for-profit balance sheet and income statement. A full set of financial statements for a nonprofit includes: the Statement of Financial Position, Statement of Activities, Statement of Cash Flows and Statement of Functional Expenses. The first three somewhat resemble for-profit financial statements with some key differences. The last, the Statement of Functional Expenses, is unique to nonprofit organizations. We can relate nonprofit financial statements to the following for-profit statements below:

The American Institute of Certified Public Accountants (AICPA), in conjunction with the Financial Accounting Standards Board (FASB), offer the key inputs to the development of nonprofit financial reporting standards. Nonprofit financial reporting standards include a unique emphasis on transparency as to the organization’s liquidity, existence of restricted funds, as well as the breakdown of funds spent on administrative, program and fundraising-related functions (which is shown in the Statement of Functional Expenses). The audience reading these statements usually includes grantors, donors, government agencies, lenders, and other key stakeholders in the community.

The Statement of Activities and Statement of Functional Expenses have the most differences from their for-profit entity counterparts. The Statement of Activities for nonprofits includes more information about the organization’s receipt and use of donor-restricted funds. Also, it includes more information about the function or purpose of the organization’s expenses. The Statement of Functional Expenses shows a breakdown of natural expense types (like salaries, benefits and supplies) across their functional uses (administrative, programs and fundraising). Overall, the goal of these differences in nonprofit financial reporting is to emphasize how the organization is using its public funds. This helps donors and grantors decide on whether to support a given organization and how they are stewarding funds.